- Nov 25, 2025

- 9 min read

UBO: Understanding the Ultimate Beneficial Owner (2026)

In this article, we explain who UBOs are and why it’s important to verify them—with a step-by-step guide on how to do it.

Regulators worldwide have been working to develop methods to combat the spread of money laundering. Following the Panama Papers leak, governments identified a due diligence loophole: a lack of transparency in beneficial ownership. This allowed criminals to transfer illicit funds offshore while obscuring their identities, evading appropriate due diligence measures, and circumventing established Anti-Money Laundering (AML) safeguards.

Regulators began to fight back by implementing rules on Ultimate Beneficial Owners (UBOs) and the information that businesses must provide about them. Now, an ever-growing number of countries have regulations requiring financial institutions and other obliged entities to identify and report on UBOs connected to their customers. The EU first introduced UBO checks in 2020 as part of its 4th and then 5th AML Directive, and has now enhanced these requirements under the new AML Regulation. Meanwhile, countries such as Saudi Arabia and China have introduced their own measures to identify and verify UBOs.

Some regulators have the authority to strike companies off the registry or seek court injunctions to enforce compliance if UBO obligations are not met. This can jeopardize a company’s legal standing and ability to operate.

At Sumsub, we have prepared a guide explaining UBOs and the methods for identifying and verifying such individuals.

What is a UBO?

A UBO, or an Ultimate Beneficial Owner, is the individual who ultimately owns or controls a legal entity through direct or indirect ownership of a sufficient percentage of the shares or voting rights or ownership interest in that entity, including through bearer shareholdings, or through control via other means. Depending on the jurisdiction, one can be considered a UBO if they own a substantial part of a company (e.g., 10-25%) and have voting rights. It’s also important to distinguish between direct and indirect ownership when touching on UBO.

Direct ownership is a form of control in which the beneficial owner holds a sufficient shareholding or ownership interest in a company to exercise influence or decision-making power.

Indirect ownership is a manner of exercising control over a company through another company or multiple companies in the same proportion. Where, after all, possible means of identification have been exhausted, the beneficial owner cannot be identified, and there is no doubt that such a person exists, or where there are doubts as to whether the identified person is a beneficial owner, the natural person who holds the position of a senior managing official is deemed a beneficial owner.

AML-obliged entities (i.e., those dealing in securities, currency exchange, commodities, forex, binary options brokers, hedge funds, casinos, futures commission merchants, blockchains, digital lenders, etc.) have to establish and monitor the UBOs of their company-clients.

In some jurisdictions, different terms are used to refer to UBOs. For example, in the UK, they are called ‘People with Significant Control’, and in Singapore, they are known as ‘Registrable Controllers’.

What does UBO mean in business?

In business, the term UBO refers to a person who ultimately controls a legal entity, such as a company. They may directly own the entity or a significant share of it, or they may control the person or people who have legal ownership.

In the case of criminal enterprises, there may be efforts to obscure who the UBO or UBOs are, such as using offshore shell companies or complex management structures. For example, a company in France might be owned by another company registered overseas, with this shell company then owned by another company in a jurisdiction that does not require the disclosure of UBOs.

Financial institutions and businesses in jurisdictions with UBO verification requirements must ensure they have the necessary processes and tools in place to correctly identify and verify the UBOs of their customers. This helps to ensure transparency and reduce the potential for money laundering and other forms of financial crime.

Understanding the structure and Ultimate Beneficial Ownership of a business is essential for a risk-based approach to AML. It is only possible to properly risk-score a customer and carry out the right level of Customer Due Diligence if UBOs are known. Otherwise, their risk factors cannot be effectively assessed.

Suggested read: AML & Fraud Risk Assessment in 2025: Risk Matrices, Risk Scoring, and Best Practices

Difference between a Legal Owner, a Beneficial Owner, and a Beneficiary

1. Who is a Legal Owner?

A legal owner is the person or entity whose name appears on official ownership records (e.g., share registers, corporate documents).

They hold legal title to the shares or assets of a company.

However:

The legal owner is not always the person who ultimately controls the company.

2. Who is a Beneficial Owner (or Ultimate Beneficial Owner – UBO)?

A beneficial owner is the natural person who ultimately owns or controls a legal person, regardless of whose name appears on the legal documents.

A beneficial owner may have control through:

- ownership interests (shares or voting rights), or

- other means of ultimate effective control (e.g., influence over management, decision-making power, control through agreements, or indirect ownership chains).

Key point:

Even if the beneficial owner does not hold shares in their own name, they must still be identified if they exercise ultimate control.

3. Who is a Beneficiary?

A beneficiary is someone who receives a financial benefit from an arrangement, such as:

- a trust,

- an insurance policy,

- a contractual payment, or

- another legal structure.

Key point:

A beneficiary receives benefits but does not necessarily exercise control over the entity or arrangement.

Why Ultimate Beneficial Ownership matters for compliance

Companies that comply with Anti-Money Laundering (AML) regulations have to identify UBOs to prevent financial crime, such as money laundering, being conducted through shell companies.

Jargon decoder: Shell companies exist on paper and hold no significant assets. They are often set up in jurisdictions with favorable tax and regulatory regimes to allow another company to offshore certain activities. Shell companies can have legitimate uses, but are also sometimes used by criminals for purposes such as money laundering and tax evasion.

The Panama Papers leak in 2016 exposed the widespread use of anonymous shell companies for criminal activity, including tax evasion and money laundering. As a result, regulators moved to introduce legislation requiring financial institutions to identify and verify the identities of the people who will ultimately benefit from any transactions initiated on their platforms. The goal is to increase transparency and reduce opportunities for money laundering and other forms of financial crime.

UBO verification is now a crucial component of the KYB (Know Your Business) and KYC (Know Your Customer) processes. This allows obliged entities to show that they have identified and verified the ultimate beneficiaries of any transactions initiated by their customers. UBO checks will include screening individuals against sanctions lists and other watchlists, and assigning them a risk score based on the likelihood of their being involved in financial crime.

It is only through these steps that proper due diligence can be carried out, as otherwise known criminals can use ‘clean’ intermediaries to carry out illicit activity on their behalf, avoiding scrutiny.

Failure to comply with UBO verification regulatory requirements can have very serious consequences, including fines, risks to institutions’ licenses, negative publicity, and loss of customer confidence.

How to identify a UBO

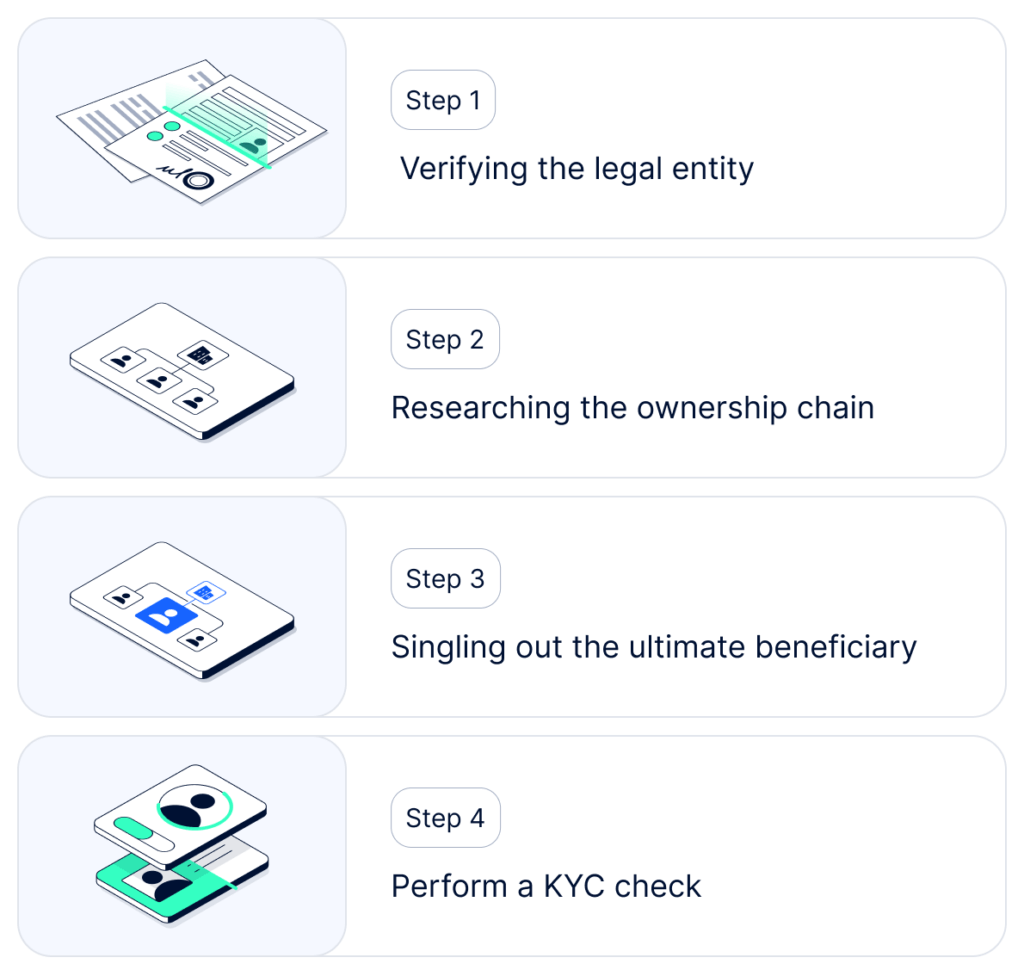

The procedure of UBO verification can be separated into four steps.

#1. Verifying the legal entity

To verify the legitimacy of a company and the accuracy of its records, it’s necessary to collect certain information. The required information might vary depending on the jurisdiction and fraud regulation standards. Generally, the following information should be collected:

- Register number

- Name

- Address

- Type

- List of top management

The provided information has to be verified by reliable documents or data, or a combination of both.

#2. Researching the ownership chain

Documents or registry information can help identify natural persons who have a percentage of shares or interests in a firm, and whether this control is direct or indirect. In case shares are held by intermediary legal entities, the full ownership structure should be analyzed until controlling natural persons (the UBOs) are ascertained.

#3. Singling out the ultimate beneficiary owner

Companies should learn about the total percentage of shares, ownership stake, or possible indirect control of every individual and calculate if one of them falls under the definition of UBO.

#4. Perform a KYC check

All of those deemed as UBOs have to go through the full Know Your Customer (KYC) check, which we’ll explain below.

UBO declaration and required documents

Businesses in countries and regions with UBO disclosure requirements may, on a case-by-case basis, need to complete a UBO declaration during onboarding with a new financial services provider or other regulated entity. This declaration must identify all UBOs in accordance with the rules of the relevant jurisdiction.

Companies may also be required to file the details of their UBOs with an official register in their country. This database contains information about who ultimately controls various companies. In some countries, this information is publicly available, such as in the UK, where details of UBOs or ‘People with Significant Control’ are available to everyone through Companies House. In other countries, this register may be private and only disclosed when required, such as Singapore’s Central Register of Registrable Controllers, which is not available to the public and can only be accessed by law enforcement agencies for the purposes of carrying out their duties.

UBO declaration requirements

The exact requirements for a UBO declaration will depend on the country or region, but will typically include information such as:

- Personal details. Including the full names, dates of birth, countries of birth, nationalities, ID/passport data, and addresses of each UBO.

- Degree of ownership and control. For example, what percentage of shares each UBO holds, their ownership rights, and any other forms of control they may exert.

- Nature of control. Covering exactly how each UBO exerts control over the company.

- Date of the declaration. Affirming that the information provided was correct as of this date.

Performing KYC on UBOs in financial services

Once UBOs are identified, companies must verify them using a KYC solution. This includes establishing a proper Customer Due Diligence (CDD) procedure, which involves collecting, verifying, and monitoring information provided by customers.

If it turns out that an established UBO is a high-risk customer, then Enhanced Due Diligence (EDD) monitoring should be conducted.

Sanctions, PEPs, and adverse media screening

Companies also have to implement Anti-Money Laundering (AML) screening to check whether their customers are on any sanction lists (OFAC, UN, HMT, EU, DFT, etc.), PEP lists, adverse media, and so on.

Even after the onboarding stage, customers should be monitored on an ongoing basis in case they end up on a sanctions list later on.

Ongoing monitoring

CDD checks have to be continuous as there’s always a chance that a customer’s profile changes over time. For example, a UBO can later be sanctioned, conduct high-risk transactions, or make changes to their personal information.

For this reason, it is important to conduct periodic verification. Periodic verification enables automatic, ongoing due diligence for KYC and KYB applicant checks, thus minimizing compliance risks and streamlining daily operations. It’s typically based on three key parameters: applicant data, timeframes, and actions applied to selected applicants. This approach ensures that organizations remain compliant, reduce manual effort, and scale their operations confidently.

Sumsub is the only solution on the market that covers all KYB needs from A to Z, including corporate registry checks, ownership structure checks, AML screening, corporate documents verification, UBO verification, periodic verification, and more.

Common challenges in UBO verification

UBO verification is not always straightforward. This is especially true where there may have been intentional efforts to obscure who a company’s UBOs are and/or when dealing with companies in jurisdictions with less stringent regulations.

Some of the most common challenges in UBO verification currently include:

- Opaque structures. For example, where layers of shell companies and/or offshore entities are used to hide who ultimately controls a company. It is important to use verification tools that can effectively untangle these structures and work out who the UBOs are so they can be accurately risk-assessed.

- Data accuracy. UBO verification relies on having access to accurate information about companies, their structures, and their key people. If this information is incomplete or inaccurate, it may not be possible to effectively verify who the UBOs are and complete the necessary AML checks. In some cases, the available data about a company might be intentionally inaccurate as part of a criminal enterprise, but it could also be missing or wrong due to factors such as human error. Finding a UBO verification solution that only uses trusted sources and can quickly spot false or incomplete data is critical for compliance.

- Cross-border compliance issues. The rules around UBO disclosure and verification vary widely between countries and regions. Regulated entities must ensure compliance in all jurisdictions where they operate, as well as understand the challenges that can arise if dealing with companies in areas without UBO disclosure requirements. Flexible KYC and KYB systems are needed to facilitate compliance with these different requirements, while also being able to quickly flag any companies associated with high-risk countries, such as those that do not enforce UBO disclosure.

- Limited access to reliable registries. In many jurisdictions, public beneficial ownership registries are either non-existent, outdated, or lack verification mechanisms. This limits the ability of compliance teams to cross-check ownership data against trusted official sources and can slow down onboarding and due diligence processes.

- Frequent changes in ownership. Company ownership structures can change frequently due to mergers, acquisitions, or internal restructuring. Without continuous monitoring and automated updates, previously verified UBO information can quickly become outdated, increasing the risk of compliance gaps.

- Technology and integration limitations. Many organizations still rely on fragmented or manual processes for UBO verification. Without systems that can integrate various data sources and apply AI-driven entity resolution, there’s a higher chance of errors, inefficiency, and missed risk indicators.

Expert insight: Improving transparency through technology

How Transferra verifies businesses 50% faster with Sumsub

Digital payments platform Transferra offers fast cross-border transfers for businesses and enterprises. They provide tailored, high-touch support for over 1,000 registered clients across the UK, Europe, and Switzerland. As part of their regulatory compliance obligations, Transferra needs robust identity verification that also facilitates the smooth onboarding of new customers.

As the company grew, they realized they needed a flexible KYB process to match their various customer profiles while reducing the manual workload that could significantly slow down onboarding. This would allow them to fully meet their regulatory requirements, including around UBO identification and verification, without creating a slow, onerous onboarding process for their customers.

By partnering with Sumsub, Transferra was able to take advantage of our business verification and user verification solutions. We were able to automate many of these key processes, cutting the team’s workload, ensuring regulatory compliance, and speeding up customer onboarding.

As a result, KYB processing time (including UBO verification) was cut by over 50%, while onboarding rates increased, and they experienced fewer rejections and errors. Transferra is now working on expanding across the EU, with Sumsub’s solutions helping to set them up for rapid scaling as required.

Automating UBO compliance

With UBO verification now becoming a standard part of AML requirements in many countries and regions, obliged entities must be able to guarantee compliance. It is essential to have KYC and KYB tools that support UBO verification and can automatically adjust to the requirements of different jurisdictions.Sumsub’s Ultimate Beneficial Ownership verification makes this process faster and more accurate, while cutting workloads and making onboarding less onerous for customers. It not only simplifies compliance - it helps to build trust with customers and regulators alike.

FAQ

-

What is a UBO?

A UBO is the individual who ultimately owns or controls a legal entity through direct or indirect ownership of a sufficient percentage of the shares or voting rights or ownership interest in that entity, including through bearer shareholdings, or through control via other means.

-

What does UBO stand for in business?

A UBO stands for “Ultimate Beneficial Owner”. A UBO is an individual who has ultimate control over a business.

-

Why is it important to identify UBOs?

It’s important for companies to identify UBOs for several reasons. First, it prevents criminals from using shell companies to hide their identities, which in turn prevents money laundering. Second, companies have to identify and verify the UBOs to comply with AML regulations.

-

How is a UBO identified?

UBOs are identified by collecting a company’s credentials, such as its name, registration number, address, and senior people, including all directors. The company’s ownership chain must then be investigated to determine the identities of everyone holding shares or other interests in the business. Each identified person must then have their percentage of shares, management control, and ownership stake worked out so that it can be determined who meets the definition of a UBO under the relevant rules. All of this information should be checked against trusted sources, and the identified individuals will need to go through appropriate AML checks.

-

What is a UBO certification?

Any individual opening a business account has to complete a certification, which includes their name, address, and other personal information.

-

What is a UBO check?

This is when information provided by a UBO gets verified and screened against a variety of sanctions, PEPs lists, and adverse media.

-

Why is UBO compliance important?

UBO compliance is a regulatory requirement in many jurisdictions, so obliged entities operating in these jurisdictions are legally compelled to identify and verify UBOs. Failure to meet these requirements could result in fines, as well as other enforcement actions, such as having conditions placed on an institution's license or even having their license removed. Breach of UBO regulations can also result in very negative publicity and may affect customer confidence in a brand.

-

What are the consequences of not complying with UBO regulations?

If a company doesn’t comply with regulations, it can be subject to fines and other penalties (e.g., license revocation and fines).

-

What documents are required for UBO verification?

The exact UBO document requirements will depend on the entity and the regulatory requirements in the relevant jurisdiction. In general, documentary proof about the entity will be required for things like the company’s registration details (e.g., the company number and jurisdiction of incorporation), formation (e.g., articles of association), share ownership, business structure (e.g., shareholders’ agreement or partnership agreement), and how the business is controlled. Personal documents, such as passports and driving licenses, will also be needed for all relevant people connected to the business, such as directors and shareholders.

-

What is the difference between the Legal Owner, Beneficial Owner (UBO), and Beneficiary?

The legal owner is the person or entity whose name appears on official records as holding the shares or assets of a company. They hold legal title but may not be the person who actually controls the company.

The beneficial owner is the natural person who ultimately owns or controls a company, either through ownership or other means of effective control. They may control the company even if they are not listed as the legal owner.

The beneficiary is someone who receives a financial benefit from an arrangement (e.g., a trust, insurance policy, contract) but does not necessarily have control over the entity.

Relevant articles

- Article

- Oct 7, 2025

- 16 min read

- Article

- Sep 22, 2025

- 10 min read

Learn everything you need to know about bonus abuse, the most common techniques, and how your company can prevent it.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.