What’s Money Muling? Understanding Red Flags and Why Businesses Should Be Concerned

Discover one of the fastest-growing fraud trends of 2024, and learn how businesses can protect themselves from this threat.

Money muling is a form of money laundering where criminals employ other individuals to move illicit funds. According to Sumsub’s 2023 Identity Fraud Report, money muling networks are one of the top-5 global fraud trends.

In 2023, Europol, Interpol, and Eurojust identified 10,759 money mules and 474 recruiters, leading to the arrest of 1,013 individuals worldwide. In the UK, Cifas, a non-profit fraud prevention organization, estimates that there were 37,000 bank accounts demonstrating behavior associated with muling in 2023. In Singapore, 4,800 people were arrested or investigated for money muling in the country in 2020. In 2022, this figure increased two-fold.

Who’s a money mule?

A money mule is a person recruited by criminals to launder illicit funds. Mules usually have a clean banking history and no criminal record. This allows them to move criminal money without getting noticed.

Money mules are recruited through online job offers, dating sites, remote villages, or darknet forums. Recruiters can lure individuals by promising easy money or creating job adverts that appear like legitimate offers.

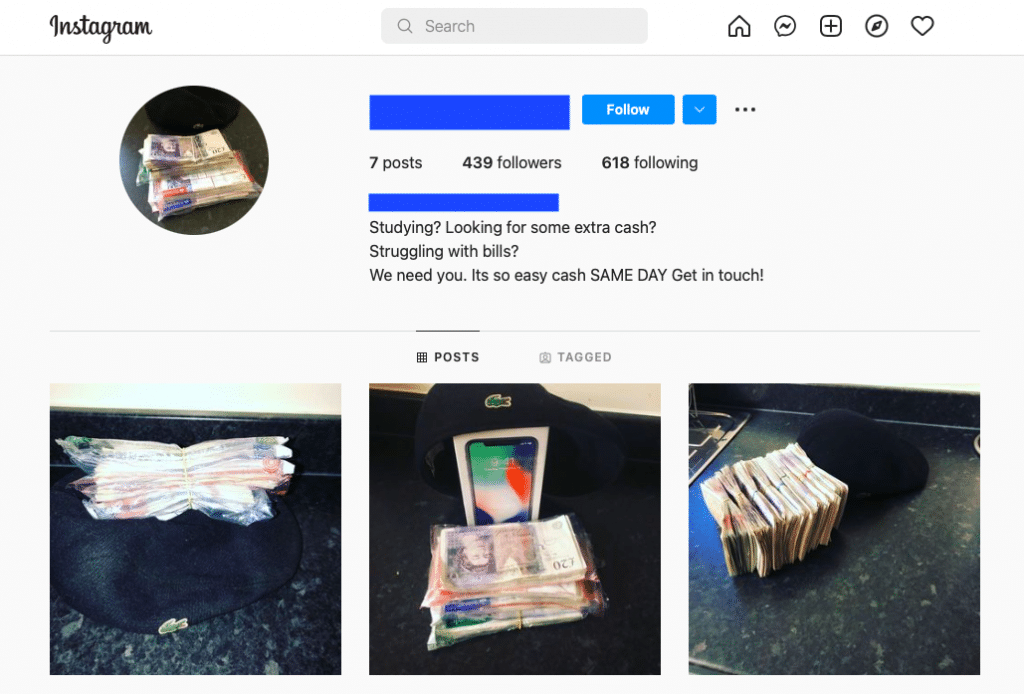

Here’s an Instagram account of a potential mule recruiter. Such recruiters often take pictures of large sums of money and promise easy cash to lure young people.

Europol, an organization that fights terrorism and other organized crimes, describes the categories of people most often targeted for money muling:

- People in economic hardship. These include unemployed individuals, students, and immigrants.

- Young people. Criminals target young individuals the most, sometimes even recruiting teenagers. In the UK, around 23% of money mules are under 21, and 65% are under 30, according to estimates. Another study by the Singapore Police Force involving 113 money mules found that about 45% were 25 or younger.

- Elderly people. The UK’s Cifas reported a 34% increase in money muling among 40-60-year-olds in 2021.

FBI: Glenda, an 81-year-old victim of a romance scam, describes how she became a money mule and is now paying the price

All in all, businesses should conduct proper due diligence for all age groups, even for elderly customers who look the least suspicious.

Criminals can also open business accounts for money muling. In 2020, there was a 26% increase in such accounts compared to the previous year. Criminals use business accounts to move large sums to make them appear less suspicious.

Suggested read: 4 Ways to Protect Your Business from Chargeback Claims

Types of money mules

Some money mules know they are supporting criminals while others are unaware. According to the FBI, money mules can be divided into three types:

- Unknowing, or unwitting, individuals. These people are unaware they are part of a laundering scheme. These could be victims of online romance scams, or fake job offers

- Witting individuals. These people willfully ignore red flags or prefer not to notice money laundering activities. They usually get paid

- Complicit individuals. These are professional money mules who are trained to subvert financial institutions and law enforcement.

Feel free to save this picture to your device

The BBC reported on a young woman who became a witting money mule. When Holly (not her real name) was still in school, she was approached on social media by a person who promised to pay her for letting him use her bank account. She knew it was suspicious but handed over her bank card anyway.

“He was convincing me. He showed me other people that he’s worked with about how much money they got and he just kept on pestering me for my card and I just eventually gave in,” she told the BBC in a radio interview.

The story didn’t end well for Holly. She was soon discovered and blocklisted from all banking services for at least six years.

Serving as a money mule damages one’s credit and financial standing. Consequences include closure of payment accounts, loan and credit denial, difficulties getting a phone contract, and others. Also, law enforcement agencies warn that muling is a serious crime that can lead to up to 14 years of imprisonment in the UK and 30 years in the US.

If an individual suspects that they might be a mule, they must stop communicating with the criminal and warn the police.

How does money muling work?

Money muling involves the following steps:

- Criminals recruit a mule through an online job or dating site

- The mule opens an account with a bank or other financial platform or uses their existing account

- Money is sent to the mule’s account from a criminal source, such as a fake company

- The criminals instruct the mule on when and where to move the money. They can request the mule to make a wire transfer or give account access to another person

- The money mule gets a cut for their participation.

It’s harder to track illegal money movement involving unknowing individuals, who usually have verified payment accounts classified as low-risk. Such accounts are subject to less monitoring, which increases the chance of fraudulent transactions going unnoticed.

Money laundering through money mules

In 90% of cases, criminals use money mules to launder proceeds from cybercrime, including malware and romance schemes. It could also be from something more vicious, like human and drug trafficking.

The FBI explains that money mules can move funds through bank accounts, cashier’s checks, virtual currency, prepaid cards, or money service businesses. This helps criminals avoid Customer Due Diligence (CDD) procedures, hiding their identities and sources of funds.

A real-life story about a Russian rapper who worked as a money mule and helped a criminal syndicate to launder money (step-by-step breakdown of the laundering scheme).

Money muling networks usually utilize the following techniques to launder money acquired through investment scams, phishing, messenger app fraud, help desk fraud, crypto fraud, counterfeit bank cards, and more:

- “Bank drops”

Money launderers need to deposit illicit funds without the bank’s knowledge. To do this, they’ll pay someone with a clean banking history—somewhere in the range of $50 to $100—to open up a bank on their behalf. Typically, online “neobanks” are preferred over traditional banks for this purpose.

- Online payment methods, including gift cards

These are often furnished to money mules of a younger age demographic, who then purchase items and deliver them to the criminals. These items are subsequently sold on popular e-commerce platforms, and a share of the illegal proceeds is provided in cash or goods to the mule.

- Bank impersonation

Criminals can use deceptive tactics, including bank impersonation, to compromise people’s banking credentials. This often targets more vulnerable populations, particularly seniors.

- Fabricated identities

Not all money mules have to be real people. In fact, perpetrators often fabricate identities—often through the use of AI—which can then be used to open up fraudulent bank accounts. These fake identities can be advanced enough to bypass KYC, underscoring the need for advanced security measures and monitoring beyond the onboarding stage.

Suggested read: What Are Deepfakes?

Affected businesses

Several types of businesses are particularly vulnerable to money mule scamsdue to the nature of their operations and financial transactions. These include:

- Financial institutions. Banks, credit unions, and other financial institutions are prime targets due to their involvement in processing and transferring funds. Money mules may attempt to use these institutions to launder illicit funds or to facilitate fraudulent transactions.

- Online retailers. E-commerce businesses are often targeted because they process large volumes of transactions, making it easier for fraudulent activities to go unnoticed. Money mules may use stolen credit card information to make purchases through online retailers, exploiting vulnerabilities in payment systems.

- Money service businesses. Companies that provide money transfer services, such as Western Union, are at risk because they facilitate the movement of funds across borders. Money mules may attempt to use these services to transfer illicit funds or to receive payments from victims of various scams.

- Travel agencies. Travel and tourism businesses, tour operators, and other companies related to this industry may be targeted by scammers looking to book fraudulent trips or use stolen credit card information to make travel reservations.

- Cryptocurrency platforms. Crypto exchanges and trading platforms have become targets for money mule scams. Cryptocurrencies offer a certain degree of anonymity, as transactions can be conducted without revealing the identities of the parties involved. This makes it easier for money mules to transfer funds without being easily traced or identified, providing a layer of secrecy for conducting illicit activities.

Suggested read: Crypto Hygiene: Tips and Best Practices for Clean Crypto

- Job recruitment platforms. Websites or platforms that connect employers with potential employees are often exploited by scammers posing as legitimate businesses offering work-from-home opportunities. These scams involve recruiting individuals as money mules under the guise of legitimate job offers.

- Dating platforms. Money mules can be recruited through dating apps and platforms, often as part of romance scams where perpetrators build relationships with victims to gain their trust. Once trust is established, the scammer may deceive the victim into unknowingly participating in illegal activities, such as receiving and forwarding illicit funds. These scams exploit the emotional vulnerability of individuals seeking companionship, making them more susceptible to manipulation.

These businesses should be especially concerned with robust money mule detection and prevention measures.

Money mule red flags

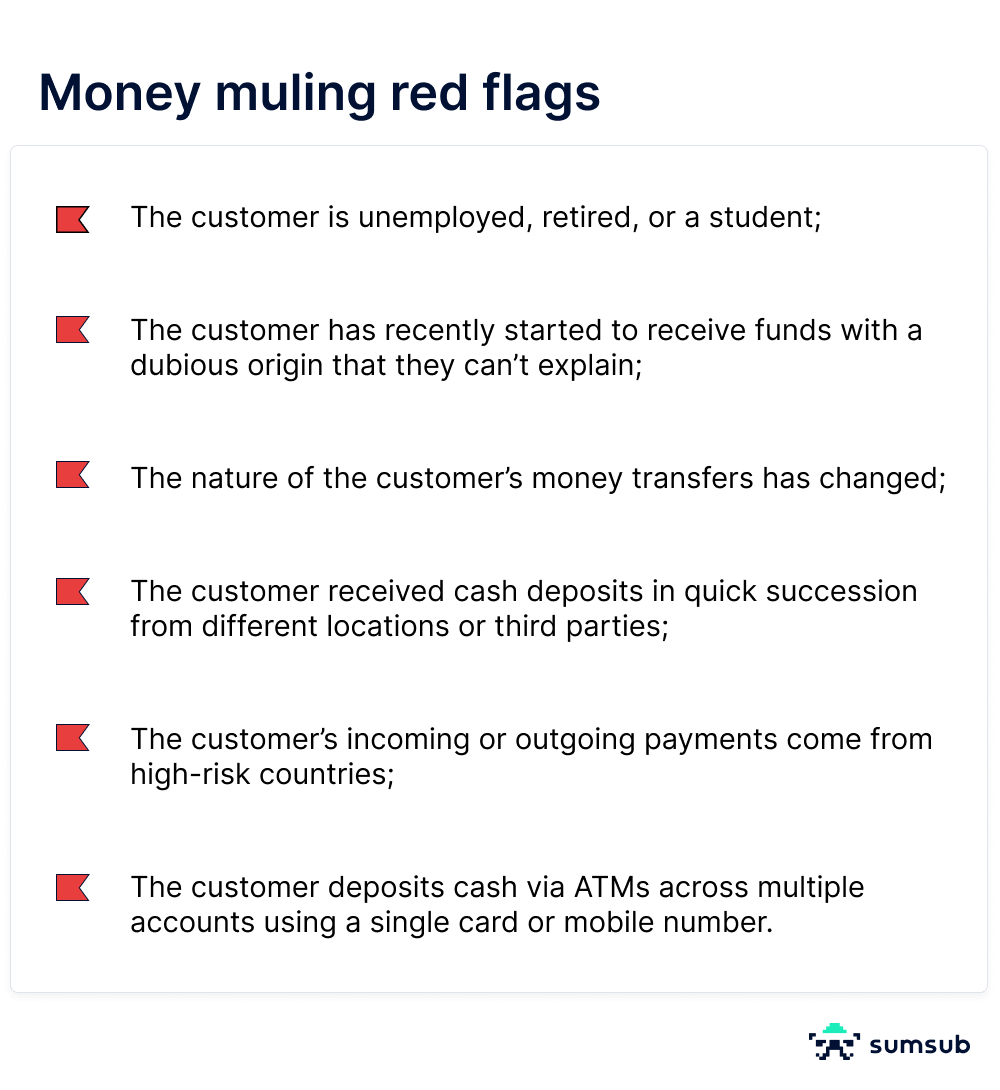

Here are the red flags of a potential money mule:

- The customer is unemployed, retired, or a student

- The customer has recently started to receive funds with a dubious origin that they can’t explain

- The nature of the customer’s money transfers has changed

- The customer received high deposits in quick succession from different locations of third parties

- The customer receives deposits and then soon after withdraws the amount

- The customer’s incoming or outgoing payments come from high-risk countries

- The customer deposits cash via ATMs across multiple accounts using a single card or mobile number.

This is a checklist with the red flags; feel free to save it to your device.

The presence of a single red flag may not be a sufficient basis for suspecting criminal activity. For instance, a customer being a student isn’t a red flag in itself. But if this customer suddenly starts to make surprisingly large transactions, it might be a sign of money muling activity.

Overall, businesses can monitor customer activity to reduce the risk of exposure to money mules.

How to detect and stop money mules

Businesses can’t afford to let money mules exploit them. In fact, if a business fails to detect internal money laundering activity, it can be charged with aiding and abetting these crimes under AML regulations.

At the same time, it’s hard to catch money mules, since these are usually ordinary people with a clean banking history. Therefore, it’s recommended to employ a complex approach to due diligence, including background checks, as well as automated transaction and profile monitoring that can notice even slight changes in customer behavior:

- Detecting mules during onboarding. Professional money mules can use stolen identities to open accounts on financial platforms. Therefore, businesses need to conduct a proper CDD procedure that verifies the customer and their documents, assigns a behavioral risk score, searches blocklists, and performs adverse media screening. A background capture and check is highly important, since there’s a possibility that a money mule was convicted of a crime in the past. It’s also important to find connections and similar patterns in the behavior of different users (such as background, device, IP address, etc.).

- Ongoing monitoring of all user activity. Businesses should consider ongoing monitoring of existing customer profiles, such as login details, personal data change, geolocation, behavior and IP location. It’s important to pay attention to even subtle changes.

- Transaction monitoring. This is a type of automated technology that detects unusual transactions in real-time. It conducts analysis that verifies the source and destination of funds and determines possible connections to money laundering

- Fraud network detection. You can uncover interconnected patterns of suspicious activity on your platform using Sumsub’s AI-powered Fraud Network Detection solution. This tool provides businesses with the ability to identify fraud networks, including money mule networks, before the onboarding stage through AI. This allows you to apprehend an entire fraud network rather than just a single fraudster.

If a business detects a money mule, it must report them to a law enforcement authority and freeze the account. It’s also common practice to communicate to other financial institutions that an identified person might be a mule. This way businesses can protect other institutions from known money mules.

FAQ

-

How do you identify money mules?

Money mules can often be identified by unusual financial activity, such as receiving funds from unknown sources, transferring money to unfamiliar accounts, or frequently making deposits and withdrawals in large amounts.

-

What is the red flag of a mule account?

There are several red flags of a mule account, for example: when the customer is unemployed, retired, or a student; when the customer has recently started to receive funds with a dubious origin that they can’t explain, or the customer deposits cash via ATMs across multiple accounts using a single card or mobile number.

-

What is the punishment for a money mule?

The punishment for a money mule can vary depending on the jurisdiction and the severity of the crime, but it typically includes potential fines, imprisonment, and a criminal record.

Explore more

- Regulatory compliance

- Aug 08, 2022

- 4 min read