- Dec 19, 2025

- 7 min read

’Tis the Season… for Scammers: Your Guide to Holiday Fraud 2026

When sales spike during holidays, so do the scams. Learn about the top fraud threats, red flags, and tools businesses and consumers can use to protect themselves against fraud losses in the rush of the holiday season.

A couple of days before her Christmas party at work, Maria saw an ad for her favorite luxury coat, promising a 90% discount. ‘What luck, my colleagues will be impressed!’ Of course, she was convinced immediately. The website domain said ‘fartetch.com’—everybody knows it, right? And the urgent messages ‘Last chance!’ and ‘Only today!’ pushed her to make that final click. She quickly made the purchase on the website, which imitated the marketplace Farfetch—only to realize later that she had been scammed and lost double the coat’s original price.

Unfortunately, Maria, like many others, became a victim of a phishing scam that convincingly imitated a well-known website and used psychological pressure. Many people fall for these schemes, ending up buying gifts from fake shops or unintentionally sharing sensitive information, such as credit card details, with criminals.

Year after year, important holidays like Thanksgiving, Diwali, Hanukkah, or Christmas are associated with sharp spikes in e-commerce traffic, and, unfortunately yet logically, sharp spikes in fraud. Whether it’s Black Friday, Cyber Monday, Singles’ Day, Boxing Day, back-to-school sales, or summer promotions, fraud and automated bot attacks rise with seasonal shopping demand across retail, hospitality, and travel sectors. Moreover, fraud in 2025 has become more sophisticated as fraudsters leverage AI and other technological breakthroughs, and this trend is expected to persist in the coming years.

For businesses, high volumes mean tighter delivery windows, stressed customers, and merchants overwhelmed with accelerated fulfillment. Fraudsters know that retailers are under extra pressure during these periods and do everything they can to exploit it.

However, with a festive fraud-frightening spirit, merchants can turn the annual scam surge into an opportunity for growth.

What are holiday scams, and why do scammers love holidays so much?

Holiday scams are fraudulent schemes designed to exploit seasonal shopping, charity, and travel trends in order to profit from them illegally.

There are many reasons why holiday scams surge each year, but it often comes down to the sense of urgency that business owners and customers alike feel during the holiday season.

Whether it’s customers rushing for a limited-time deal or merchants wanting to run a Black Friday promotion, scammers know holidays put their prey under pressure and use this sense of urgency to increase their chances.

Surges in transaction volumes also make manual anti-fraud reviews more challenging, and can allow fraudsters to slip through the cracks undetected. Merchants may also decide that anti-fraud controls are slowing down traffic and, as a result, could lower barriers and inadvertently expose themselves to fraud.

Scammers can also exploit weaknesses in businesses that rely on seasonal staff who are insufficiently trained in fraud prevention. Seasonal staff are often undertrained and pressured to process refunds quickly, which scammers exploit by making false “item not received” or return claims that aren’t properly verified, allowing them to keep both the merchandise and the refund.

Suggested read: Sumsub Silly Fraud Awards

The holiday scam playbook: Lessons from 2025 and trends for 2026

The FBI warns that common holiday scams include:

⚠️ non-delivery scams (where purchased goods are never delivered),

⚠️ non-payment scams (where shipped goods are never paid for)

⚠️ auction fraud (where items on auction sites are misrepresented), and

⚠️ gift card fraud (where sellers ask victims to pay with pre-paid gift cards).

However, consumers and businesses alike need to be aware of how AI and other easily accessible tools are helping to make the following scams significantly more sophisticated and easy to fall for. In 2026, we can still expect:

1. Fake websites, online stores, and advertisements: Scammers can create polished charity websites and storefronts, run convincing fraudulent advertisements, and disappear after collecting payments. In 2026 and beyond, AI-generated product imagery, fake customer reviews, and deepfakes of trusted individuals are likely to make these even more convincing.

2. Account takeovers: Stolen credentials, password reuse, and credential stuffing can also rise during peak sales. In 2026, expect growth in AI-scripted phishing and deepfake voice scams to steal credentials for account takeovers.

3. Promo and coupon abuse: Fraudsters can exploit referral bonuses, gift cards, or discount stacking. In 2026, the use of automation to mass-test coupon loopholes is likely to increase, especially as AI can assist in research.

4. Chargeback and refund fraud: Fraudulent claims of not receiving items are likely to spike during holiday periods, and AI-generated images could help make these claims appear more convincing.

5. Delivery redirect, and logistics scams: Cloned tracking pages, malicious SMS links, and fake courier calls are also likely to continue to grow through 2026.

6. Marketplace and reseller scams: Scalpers and fake resellers may use AI to push counterfeit goods or non-delivery scams.

Perfect scam storm: E-commerce fraud on the rise during the gift-giving season

Alongside general fraud trending upward over the past three years, e-commerce fraud spikes massively during gift-giving seasons. A number of reports support this trend. According to TransUnion’s 2021 data, suspected e-commerce fraud attempt rates between Thanksgiving and Cyber Monday were about 25% higher than during other times of the year, and nearly 17.5% of those transactions were flagged as potentially fraudulent globally. According to another 2024 study, bad bot activity—which often underlies account takeover and payment abuse—has been observed to spike two to three times during peak holiday shopping days compared to normal traffic, with significant increases in checkout fraud and gift-card fraud. Moreover, several cybersecurity summaries show dramatic increases in phishing and related fraud attacks in the lead-up to Black Friday and over major holiday weeks (e.g., hundreds-of-percent spikes in certain categories).

The urgency of holiday periods makes people more susceptible to fraud, whether they are traveling to visit friends, buying last-minute gifts for family, donating to charity, or trying to take advantage of seasonal promotions. It makes for a perfect scam storm that spoils the festive mood for customers and businesses alike.

Suggested read: What Is Chargeback Fraud and How to Prevent It in 2025

How holiday scams target consumers

Holiday scams target consumers by exploiting increased spending, travel, and emotional stress during busy seasonal periods. Scammers impersonate trusted brands, delivery services, charities, or popular apps and use urgent messages like fake shipping alerts, account warnings, or limited-time deals to pressure people into acting quickly.

Social engineering and psychological pressure play a key role here, as spending naturally increases during gift-giving seasons, making consumers more susceptible to promises of extra discounts, exclusive offers, or “too-good-to-miss” deals that lower skepticism and encourage impulsive decisions.

Shop smart, stay safe: How customers can protect themselves from holiday scams

For consumers, the FBI highlights the importance of cybersecurity hygiene, knowing who you’re buying from or selling to, checking you’re buying from a legitimate company, checking reviews, not paying for items with pre-paid gift cards, and closely monitoring the shipping process.

We've also gathered a top 10 essential holiday fraud protections that are quick and easy to remember:

- Use strong, unique passwords and enable two-factor authentication (2FA)

- Verify websites use HTTPS and legitimate domains before purchasing

- Avoid deals that seem too good to be true

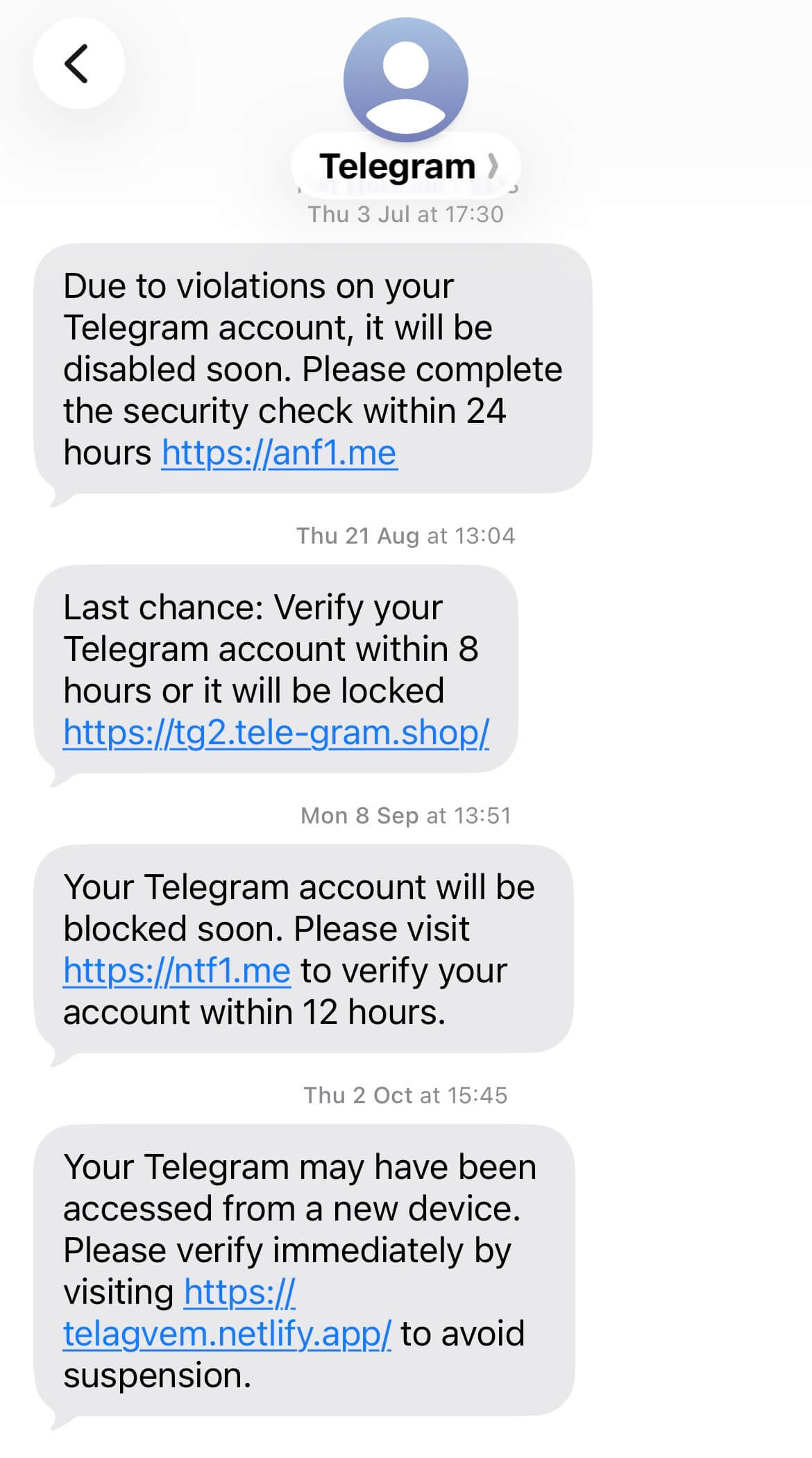

- Never click links or download attachments from unknown messages. Here’s a real screenshot from a Sumsub employee’s device:

Notice that the sender appears as “Telegram,” even though it isn’t—scammers can name themselves anything and make messages look legitimate. Always check the links carefully. Telagvem, tele-gram—really? It may look convincing at first glance. Unfortunately, the same type of message can come from “Amazon,” “Tesla,” or any other brand scammers choose to impersonate, therefore:

- Be cautious of urgent messages offering great discounts or threatening account suspension

- Keep software and apps updated to patch security vulnerabilities

- Avoid using public Wi-Fi or public computers for shopping

- Review social media privacy settings and avoid suspicious ads or giveaways

- Teach family members to recognize phishing and holiday scams.

How holiday scams target businesses

Fraudsters exploit the same sense of urgency during the holidays to take advantage of businesses as they do consumers. They do so by looking for vulnerabilities. This could be rushed approval processes, seasonal staffing gaps, overwhelmed employees, reduced manual review capacity, incomplete return processes, and a failure to have processes in place to help prevent chargeback fraud.

In 2025, businesses were expected to lose $15 billion to fraudulent chargebacks, with chargeback volume projected to climb from $33.79 billion in 2025 to an estimated $41.69 billion by 2028, according to a study by Datos Insights.

For businesses, however, costs can go beyond chargebacks. Scams can lead to reputational damage, erode trust, and create additional operational and restocking losses.

🚩Key holiday fraud red flags to watch this season:

- Rapid repeat orders from the same IP or device

- Multiple failed payment attempts across different cards or accounts

- Mismatched shipping and billing data

- Suspiciously high-value gift card purchases

- First-time customers placing large, urgent orders

- Accounts created right before purchase (no browsing history, no prior interactions)

- Multiple accounts created with similar email patterns (e.g., john1234a / jane1234a)

- Unusual delivery instructions

- Orders from regions with an elevated fraud risk

- Sudden spikes in refund requests or voucher use.

How to protect your business from holiday fraud in 2026

The holiday season is a great time of year for business promotions, but extra caution is needed. A comprehensive holiday defense strategy should include:

⚡ Strong identity and liveness verification that help detect deepfakes, synthetic IDs, fake accounts, and ATO attempts from the outset

⚡ Device fingerprinting and behavioral analytics that identify suspicious patterns across sessions, devices, and geolocation

⚡ Payment fraud prevention that applies dynamic risk scoring, BIN checks, velocity rules, and card-testing defenses

⚡ Real-time monitoring that detects coupon abuse and account anomalies before it’s too late

⚡ Customer education that communicates clearly about scams, returns, and delivery processes to reduce the risk of falling prey to phishing attacks

⚡ Automated workflows that scale fraud review capacity without overwhelming staff

Automated monitoring and anomaly detection are crucial for combating fraud at any time, but especially during busy periods like holiday seasons.

Suggested read: Hot New Fraud Trends in 2025: AI Scams, Pig Butchering, and Mobile Payment Attacks

Expert insight: Preventing holiday fraud spikes

Preparing for 2026: Building a fraud-resilient holiday strategy

As 2026 approaches, the fraud landscape is shifting toward even more complex, AI-assisted threats. We’re already seeing smarter impersonation scams that jump across social platforms, marketplaces, and apps, as well as threats becoming harder to distinguish from real shoppers. Attacks are faster, more coordinated, and increasingly difficult to catch with manual checks or isolated tools, especially during seasonal peaks.

We at Sumsub know that combining identity verification, transaction monitoring, and behavioral analytics delivers strong levels of defense. Fraud signals often sit across multiple systems, so a more unified approach means more effective prevention.

Businesses need more than one-off fraud filters or reactive review queues. A future-proof strategy requires a unified risk engine, end-to-end KYC/KYB workflows, real-time behavioral monitoring, transaction monitoring, and fraud prevention, all working together.

Coupled with proactive staff training, these capabilities form the backbone of a fraud-resilient holiday season. Companies using integrated, holistic systems rather than patchwork solutions will be far better positioned to respond to seasonal pressure and detect threats early.

Unfortunately, holiday scams aren’t going to go away. However, with the right preparation, businesses and consumers alike can stay festive and fraud-resilient.

FAQ

-

What are the most common holiday scams?

Common holiday scams include non-delivery and non-payment scams, fake online stores, gift card fraud, auction fraud, account takeovers, coupon abuse, and refund or chargeback fraud. Delivery-redirect scams, fake courier messages, and impersonation schemes also surge during major sales events when both shoppers and merchants are under time pressure.

-

How do holiday scams affect e-commerce businesses?

Fraud rises during the holidays because higher transaction volumes, urgent delivery expectations, and distracted shoppers and businesses create ideal conditions for scams. At the same time, businesses may face staffing gaps and reduce friction to handle demand, which opens the door for sophisticated fraud attempts.

-

How can companies detect fraudulent transactions during holidays?

Businesses can flag suspicious activity using device fingerprinting, behavioral analytics, and identity verification checks (KYC/KYB). Real-time monitoring is crucial, as fraud patterns shift quickly during high-volume shopping periods.

-

What tools help prevent holiday season fraud?

In addition to education and good cybersecurity hygiene, identity verification, liveness checks, behavioral analytics, and transaction monitoring all help reduce risk during peak shopping periods. Platforms like Sumsub streamline these capabilities and help close gaps that fraudsters might otherwise exploit.

-

Why does online fraud increase during the holidays?

Transaction volumes surge during holiday sales, giving fraudsters more opportunities to blend in with legitimate shoppers. A sense of urgency, consumer distraction, and reduced merchant scrutiny make it easier for scams to slip through.

Relevant articles

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.